Blogs/Insights

There are several important ingredients for a startup to get success. Here are some of the key factors:

A clear value proposition: It is essential for a startup to have a clear and compelling value proposition that differentiates it from competitors and addresses a specific market need.

Strong leadership: A startup needs strong and visionary leadership that can inspire and guide the team, navigate challenges and make strategic decisions.

Product-market fit: The startup needs to have a product or service that is in demand in the market and provides a solution to a real problem.

Adequate funding: Adequate funding is crucial for a startup to build and grow its business. It is essential to have enough financial resources to develop and market the product or service, hire and retain talent, and sustain operations until the business becomes profitable.

Agility and adaptability: Startups must be agile and adaptable to changing market conditions, customer needs, and technological advancements. They need to be able to pivot quickly and make necessary adjustments to their strategy and product offering.

Customer focus: Successful startups focus on delivering value to their customers and providing an exceptional customer experience. They listen to customer feedback and use it to improve their product or service.

Talented and committed team: A startup’s success also depends on the quality and commitment of its team members. Startups need to attract and retain top talent who are passionate about the company’s vision and mission.

Strategic partnerships: Strategic partnerships can help startups leverage the expertise, resources, and networks of other companies to accelerate growth and expand their reach.

Scalability: A successful startup needs to have a business model that is scalable and can support growth without compromising on quality or profitability.

Resilience and persistence: Startups face many challenges and setbacks along the way, and success often requires resilience and persistence. Founders and team members must be able to weather the storms and stay committed to the long-term vision.

The Indian Startup Ecosystem: A Thriving Hub of Innovation and Entrepreneurship

In recent years, the Indian startup ecosystem has emerged as one of the most vibrant and dynamic in the world. Driven by a growing economy, a large consumer market, and a young and talented workforce, India has become a hub of innovation and entrepreneurship, attracting global attention and investment.

The Indian startup ecosystem is diverse, with companies spanning a range of sectors, including e-commerce, fintech, healthtech, edtech, agritech, and more. Some of the most successful startups in India include Flipkart, Paytm, Ola, Byju’s, and Zomato, among others.

One of the key factors that have contributed to the growth of the Indian startup ecosystem is the government’s efforts to promote entrepreneurship and innovation through various initiatives and programs. The Startup India initiative, launched in 2016, aims to create a conducive environment for startups to thrive by providing access to funding, mentoring, and other support services.

In addition, the Indian government has introduced several policy reforms aimed at easing the regulatory and tax burden on startups and improving the ease of doing business in India. For example, the introduction of the Goods and Services Tax (GST) has simplified the tax structure and reduced compliance costs for businesses.

Another factor contributing to the growth of the Indian startup ecosystem is the availability of capital. India has witnessed a surge in venture capital and private equity investments in recent years, with investors pouring in billions of dollars into startups. According to a report by Nasscom, Indian startups raised $10.14 billion in funding in 2020, despite the challenges posed by the COVID-19 pandemic.

The availability of capital has helped startups scale their operations, expand their reach, and develop innovative products and services. It has also fueled the emergence of a robust ecosystem of incubators, accelerators, and angel investors, providing startups with access to mentorship, networking, and funding opportunities.

Moreover, the Indian startup ecosystem is benefiting from the country’s demographic dividend. India has a young and dynamic population, with over 65% of the population below the age of 35. This young and educated workforce is tech-savvy, innovative, and eager to take on new challenges, making them ideal candidates for startup ventures.

In conclusion, the Indian startup ecosystem is a thriving hub of innovation and entrepreneurship, powered by government support, availability of capital, and a young and talented workforce. With its vast consumer market, diverse sectors, and a growing economy, India is poised to become a global leader in the startup space in the coming years.

How To Build A Business When The Supply Chain Is Unreliable

It’s a tough time to be an entrepreneur. Over the last two years, access to financial capital has fallen, inflation reached its highest rate since the 1980s, a global talent shortage made recruiting and hiring loyal employees a nightmare, and supply chain disruptions have rocked the world’s economy.

Despite all of this, and in some cases because of the shift in how we’re thinking about work, the growth rate for new businesses has been at record-breaking levels for three years in a row. Startups aren’t slowing down, they are speeding up.

So how do you build a business when access to basic resources is not a guarantee? The short answer: you have to think like an entrepreneur. Entrepreneurs are creative, innovative, and used to overcoming challenges as they implement ideas that no one else has ever tried.

The power of positive thinking will carry you far, but the long answer to how to move forward with a risky new endeavor in an uncertain world is a bit more involved. Let’s explore five concrete ideas that can help you start and grow your business even facing an unstable supply chain.

1. Always have a backup plan.

A new business venture requires thousands of hours of planning, building partnerships and taking on a lot of paperwork. It would be easy, in the exhilaration of finally finishing up some of the tedious parts of starting your company, to be content with a streamlined, simplified supplier plan.

Unfortunately, if you are relying on a single supplier for any of your company’s vital resources, the odds are high that you will eventually run into trouble. There is a long list of historic catastrophes featuring tsunamis, fires, government red tape and even a shipping container stuck in the Suez Canal that cut off the supply chain to big-name companies. To mitigate this, you should have multiple suppliers, when possible, and check in with all suppliers and your internal team about what would happen if anything went wrong.

2. Produce in-house where possible.

Hands down, the best way to avoid supply chain disasters is to manage your own supplies as much as you can. Of course, not everyone has a manufacturing facility at their disposal, but there are other ways to produce at least a portion of what you need.

3D printers have become amazingly affordable and offer even small businesses a great way to produce custom parts right in their own building. Other types of production equipment can also be rented to reduce costs. As you think about your most crucial needs as a business, try to find creative ways to create those materials, instead of relying on outside sources.

When it isn’t feasible to produce things in-house, the next best option is to keep production as local as possible. Companies who already sourced raw materials from their native country were naturally better off during the COVID-19 pandemic, where shipping between countries got very tricky, very fast.

3. Scaling is Key.

Staying on top of supply chain developments is tricky enough when you are starting a business, but as your brand grows, things will only get more complex. In an uncertain economy like we have now, scaling smart is incredibly important to the success of a new company.

As control of your business becomes more fragmented, control of your supply chain tends to follow. Instead of scaling too quickly and making a mistake that you can’t recover from, keep the long-term mission and goals of your brand in mind as you scale up.

4. You’re only as good as the people you work with.

Problems will happen, there is no way around that. Whether by human error or natural disasters, businesses will face disruptions to the supply chain. That’s why it is so important to build a team of capable, trustworthy individuals that can be relied on from the very beginning.

How a company responds to hiccups in the supply chain is almost as important as avoiding them in the first place. A great team that works well together can come up with creative solutions faster than a disjointed team with constant turnover.

5. Don’t leave quality behind.

When nature interrupts even the best laid plans, most customers are fairly forgiving. As a group, consumers are not so willing to forget wilful quality problems. That is why it is vital to decide on what high-quality looks like for your brand, and stick with it no matter what. While you may be able to add luxury packing or faster shipping later on in your business, you can never step back from quality.

In 2012, Nyetimber, a British wine company, put this theory to the test. A record-breaking rainy season completely destroyed the brand’s grape crop. Nytimber, famous for making wine only from their own vineyards, decided not to harvest the grapes or import grapes for wine-making that year. No doubt the company lost money in the short run, but in the long run, Nyetimber gained priceless respect and thousands of newly loyal customers for sticking to their usual quality standards instead of taking the easy road.

Don’t let dramatic headlines about supply chain disruptions discourage you from pursuing your dream of starting a business. With a few adjustments and some out-of-the-box thinking, now can be as good a time as any to jump into entrepreneurship.

16 Business Leaders Share Non-Traditional Ways of Selling and Acquiring Customers

Katharine Spooner

Growth investor at Sprints Capital, a $1 billion AUM tech-focused growth equity fund headquartered in London.

Her strategy: Offer targeted promotions. Increasingly, early-stage consumer companies use promotional software to attract new customers. Offering 10% off to new customers is hardly revolutionary, but now many companies target prospective customers with tailored promotions, ranging from geographic targeted promotions to loyalty referral schemes. For example, a prospective customer who has spent a certain amount of time browsing a product or service online will receive a discount specifically on that product. This discount will often be time-marked—that is, the customer has a short time frame to make that purchase, which motivates them to buy.

The results: Implementing targeted promotions has become very popular, especially as people move away from expensive traditional online channels like Facebook and Google. Using software that streamlines promotions and allows for complex, omnichannel solutions is often the most efficient tactic for companies.

Hanh Nguyen

Co-founder and CEO at Y’OUR Skin, a data-driven personalized skincare brand that just works for each individual and grows along with their life.

Her strategy: Give your brand a soundtrack. We created our own music which is meant to be engaging to listen to, easy to remember and sing along with, and is designed to represent our brand. We know major brands are catching on to the idea of filing short-form videos, but not so many brands think of creating their own music to include in their videos. We did. We get our customers and influencers to use our music in their videos and spread it all over TikTok and Instagram.

The results: This tactic has resulted in hundreds of videos made with our music and spread our brand organically.

Jessie Young

Global lead, New Verticals at Uber Technologies, changing the way the world moves for the better.

Her strategy: Respond to consumer needs. If you can acquire a customer in a moment of need and deliver a magical experience, they are typically loyal for life. We often use customized customer relationship management to message specific products to customers in these times of need, with a jovial tone of voice and reliable supply. For example, we were able to ensure the supply of eggs at our grocery brand in North Asia at a time of a market supply chain shortage.

The results: At these moments of need, when you are able to bridge supply and raise that to customers, you earn trust. We engage and retain these customers at up to 1.6x rates.

Gabrielle Thomas

Founder and CEO of GT Consulting, a private collective for health and wellness business owners.

Her strategy: Empathize with customers’ pain points. I double down on my natural tendency as an introvert to listen and focus on the details. It helps me easily and quickly identify a client’s need and find ways to strengthen that need with a relevant product or service. I equally spend time working on being a little more extroverted, which helps me to extend my reach.

The results: This strategy increases our sales revenue and doubles down on our deliverability, which is where we outshine the competition.

Ashli Weiss

Attorney at Weiss Law, a technology law firm for startups and businesses.

Her strategy: Meet clients as a panel moderator. I get in front of clients by moderating panels, rather than being a speaker. As a moderator, I can tap a star-studded speaker lineup and create a topic that I know my prospective clients will attend. By uplifting the speakers with panel exposure at the conference, I also get that client the same exposure.

The results: Moderating panels strengthens my visibility. Each panel speaker shares the event to their social networks, which features me as the moderator, resulting in prospective clients outside of my network contacting me for legal services.

Shanila Sattar

Founder of AlwaysPlay Studios, supporting aspiring healers to close the wellness gap through breathwork facilitator, sound healing certifications and community-based healing.

Her strategy: Create a space in your community. I started by handing out free breathwork classes in farmers’ markets in Los Angeles, which has now evolved into creating a free and accessible directory of on-demand breathwork classes that I or my certified breathwork facilitators lead. This space has helped over 20,000 folks breathe in times of uncertainty during quarantine, aid in deep healing and ignite hundreds of aspiring wellness practitioners to come train with me in breathwork.

The results: Creating a community-based space has been a game changer in terms of the nurturing, comfort and safety people feel in these healing spaces. Referrals have increased by 80% and the number of facilitators seeking certifications has increased as well.

Lexi Aiassa

Founder and CEO of The Confidence Co, creating vegan supplements made for optimal digestion.

Her strategy: Build an online community. One in four people have gut issues, but no one likes to talk about them. We created a community to encourage our users to have open dialogue and conversation about the “taboo” that is digestive health. We use a platform called Geneva to create this community and encourage these conversations.

The results: Our users are so happy to have found a sense of community. Digestive issues are a serious problem, and it can be extremely isolating. This community-driven tactic has gained us customers who love and share our company ethos and products with everyone they know.

Danielle Thompson

Founder of Design Match, connecting passionate founders with ambitious creative talent.

Her strategy: Send out personalized videos. Sending personalized videos to founders asking what they need help with. In this hyper-automated world, everyone is just looking for a sense of connection. I have never spoken to most of my clients—they’ve only seen me on video!

The results: I remember in seven days closing $20,000 in deals with this strategy on Angelist for my old company. With Design Match, this strategy has brought in over $70,000 pre-launch from only four customers.

Kelsey Bishop

Founder and CEO of Candor, a professional network that’s focused on authentic profiles of how people work, not just what they’ve worked on.

Her strategy: Advertise in newsletters. I’ve seen substantial growth through newsletters. There are so many newsletters in our industry that focus on life in startups, the future of work, and jobs in startups. We have a natural pitch for people subscribing to these types of newsletters, so we’ve been advertising in them. Since most of these newsletters are small, it’s not terribly expensive and they have high conversion.

The results: Newsletter ads have been helping us grow 25% week over week.

Marissa Pick

Founder of Marissa Pick Consulting LLC, providing strategic consulting focused on digital transformation, content marketing, social media strategy, personal branding and more.

Her strategy: Focus on relationships. Network without an agenda. Too often, people focus on sales within the first line of an email. We’ve all been there—we quickly delete and ignore LinkedIn messages because they’re too pushy or too salesy. I’ve found building clients through building relationships and networking has been the most beneficial. I try to add value and have a clear approach to solve a business problem.

The results: I’ve been able to grow a business and clients by helping them set up campaigns and provide strategies with clear and measurable results.

Andrea Guendelman

CEO of Speak, using cohort-based learning to attract and convert talent from diverse backgrounds.

Her strategy: Start with a pilot. Invite potential customers to be pilot partners for a very reduced price and offer them the opportunity to participate in the construction of the product.

The results: For an early-stage company without product-market fit yet, that was helpful for us and also progressive for them. What started as a pilot with Amazon in 2021 ended up with more than 100 hires and a full-blown program to increase diversity at Amazon Web Services.

Dr. Melissa Barker

Founder and CEO of The Phoenix Project, a caring digital community that supports mental health and wellness—anywhere, anytime.

Her strategy: Always be pitching. I once landed a contract after sitting next to the CEO on an airplane. We talked openly and candidly about my company and the work we were setting out to do in the world. It attracted a dream client and customer base.

The results: In remaining open and passionate about what I do and why, I have attracted early partners and clients that align with our mission and values. Never be afraid to be seen. The world needs leaders building solutions that can help.

Yewande Faloyin

Founder and CEO of OTITỌ Executive Leadership Coaching, showing high achievers and entrepreneurial leaders how to confidently accelerate into more impactful leadership positions.

Her strategy: Treat your clients as partners. At OTITỌ, our sales approach is based on partnership. My team and I approach every conversation with a prospective client like we are already partners. So it isn’t my responsibility to sell them my services. Instead, it is our joint responsibility to discover—together—the benefit of our services for the prospect and agree to our fit to work together.

The results: Starting with our bottom line, this approach has resulted in increased sales and profits, more clients and securing our largest, long-term business client. My team and I genuinely enjoy the sales process, and clients who come onboard are significantly more bought into our services and take greater ownership of their success. This brings them better results and gives us significantly more referrals from prospects.

Ashley Reed

Certified Professional Coach at Ashley Reed Coaching LLC, helping high-performing executives and entrepreneurs navigate both business and life.

Her strategy: Use visualization. It might sound strange at first, but visualization—the act of imagining what you want to achieve in the future—can be a really powerful selling tool. It allows you to build a connection between your product and your target customer by immersing them in the brand story and experience, all while sitting on a call together. We used powerful tools like this when I was vice president of marketing solutions and event sponsorships at iHeartMedia and had great success.

The results: For us, it was all about immersing potential clients in these compelling stories around our event experiences. The success came in the form of selling sponsorships to our big events like iHeartRadio Jingle Ball, iHeartRadio Music Festival, and our awards show. If you can help someone feel and experience a product through storytelling and visualization, and then you have the data to support the value proposition, the selling happens on its own.

Dina Kaplan

Founder and CEO of The Path, teaching meditation for the modern mind.

Her strategy: Network everywhere you can. I talk to everyone around me, on buses, planes, subways and the supermarket. I have met people who join our meditation retreats, teacher training programs,and, of course, I have met many friends. You might think “customer” is some amorphous being, but there are potential clients all around us, all of the time.

The results: We sell out every meditation teacher training program we host, and part of this is me simply knowing a lot of people. This comes from being friendly and outgoing in my daily life and often saying yes to social invitations.

Diane Darling

Speaker and author at Skills4Today, working with individuals and corporations alike teaching both online and offline communication skills.

Her strategy: Step outside your comfort zone. I took acting and stand-up comedy classes to overcome my fear of public speaking. Stand-up comedy taught me rehearsed spontaneity—the importance of being exceptionally prepared, and to stop thinking that I sound great off the top of my head.

The results: Stepping outside my comfort zone with stand-up comedy has given me greater confidence, less overthinking, reduced procrastination and increased profit for my business.

Data Management: The Key to a Successful Sales Program

Building a robust sales program for businesses of all sizes, and particularly small businesses, is nearly impossible without a key ingredient: healthy data.

Poor data cripples revenue and business growth. And when it seeps into the CRM system the sales team relies on, sales forecasts are off, quotas aren’t met, multiple departments place the blame on each other, and nobody wins. Ensuring healthy data lives in a company’s CRM is critical to continuously maintaining a high quality of data, which in turn enables teams to more holistically view their financial pipeline and more accurately understand the status of current leads.

Here are four ways healthy data promotes a successful sales program across businesses of all sizes:

1. Streamline the sales process

Poor data quality adds friction to the sales process by slowing down sales follow-up, decreasing conversion rates and increasing the cost of acquiring customers, which ultimately stifles revenue growth and tarnishes brand reputation.

This is further complicated by human error. Colleagues forget to collect valuable information from leads. Or perhaps they don’t ask for firmographic data—the data that describes information as it relates to organizations as a whole—that helps sales ops determine lead quality. They may forget to record complete contact data, which prevents sales reps from following up on leads quickly.

These mistakes add up and cost the company valuable time and effort, which detracts from the sales process. In a recent State of CRM Data Health Study, 44% of respondents—comprising 1,241 CRM users and stakeholders—said duplicate entries in the CRM prevent them from fully leveraging their data, and 68% of respondents agreed that a bloated CRM results in unnecessary costs.

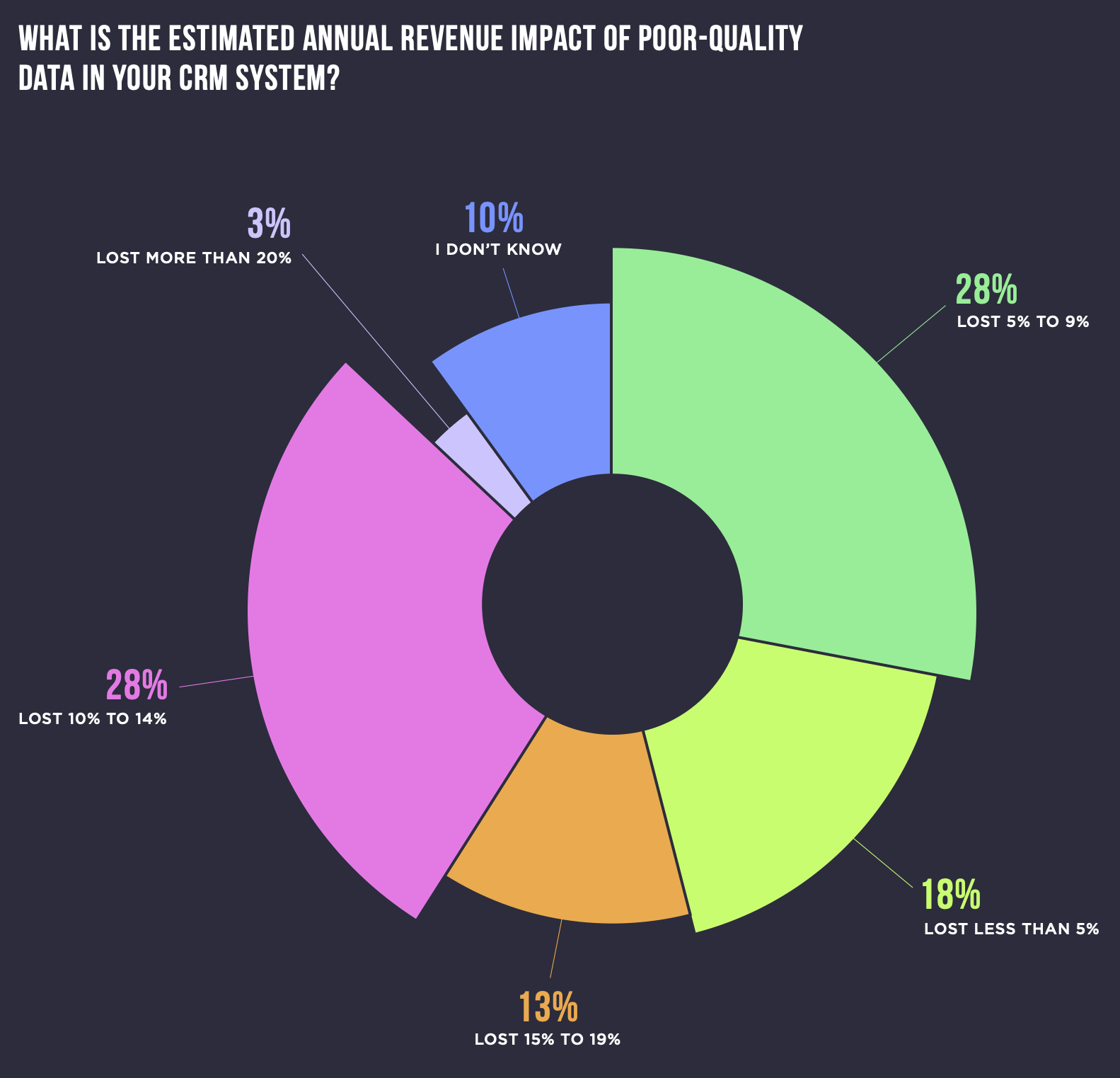

The findings even go so far as to indicate companies are losing substantial annual revenue as a result of poor data. In fact, 44% of respondents estimated their company loses over 10% in annual revenue due to poor quality CRM data. Furthermore, 37% of respondents shared that their company has delayed or halted sales pipeline processes as a result of bad quality data.

2. Empower teams to drive better leads

Prospect and customer data doubles every 12 to 18 months, and 10% to 25% of contact records include critical data errors, according to SalesIntel research. Sales teams need to use this data to properly connect with customers and present their company’s products to the market. If they are working with poor data, the company will not be able to stay ahead of the competition.

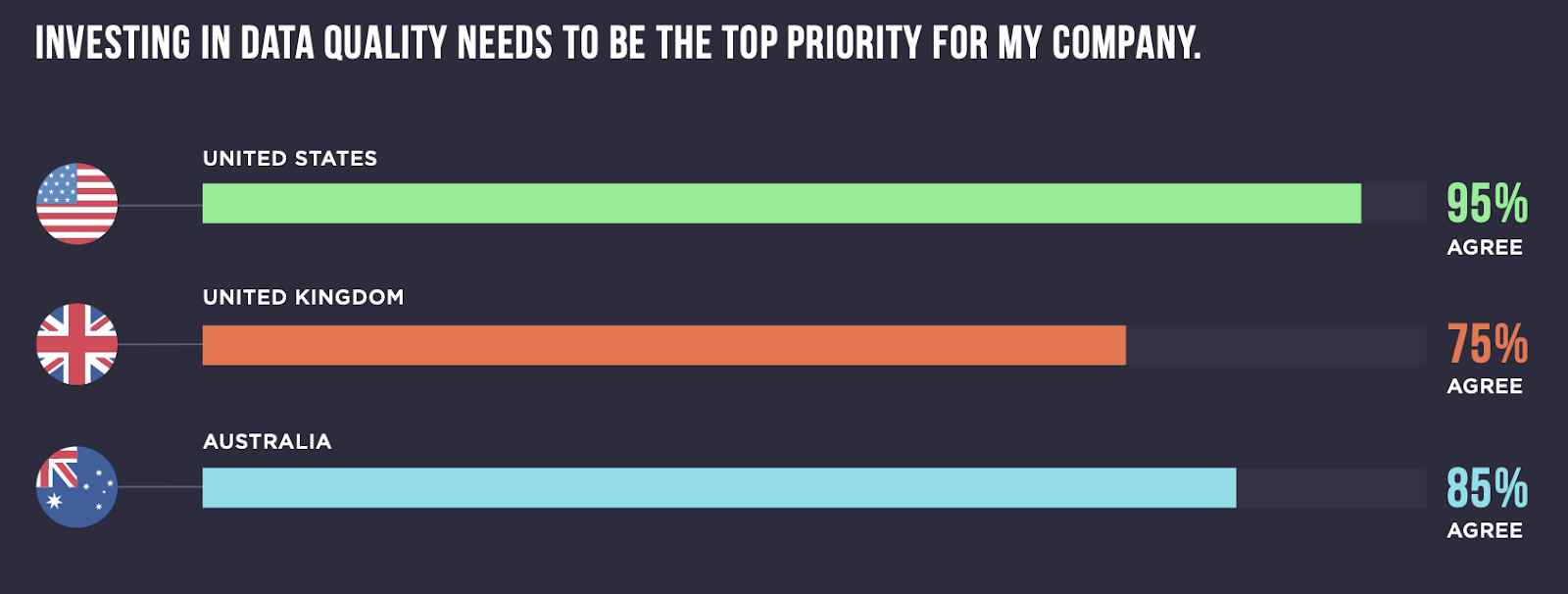

As a result, sales operations are hindered. Even if your sales reps are incredible at their jobs and your sales leaders are exceptional at forecasting, managing pipelines or identifying opportunities, the whole team’s effectiveness and efficiency drops in the face of bad data. Worse still, 64% of respondents in the State of CRM Data Health report said they’d consider leaving their jobs if additional resources aren’t allocated to a CRM data quality plan, and 94% agree that investing in data quality needs to be the top priority for their company.

When poor CRM data impedes sales, leaders exhaust internal and external resources trying to figure out what’s wrong and how to make it right. The process is often extensive and costly, disrupts workflows and productivity, and creates even more revenue loss and cost containment issues.

Oftentimes, the best way to stop harmful data decay is with a data management tool. These tools can transform outdated data management processes and make it easy for CRM admins and users to automate keeping their data clean and up to date.

3. Improve customer experiences

Data quality is essential to delivering great customer experiences according to 80% of organizations. But what has been missing in the equation is a simple and effective way to assess the quality of the data sales teams rely on and a clear picture of the impact poor customer data quality has on sales from a financial and functional perspective.

If a company’s data is filled with unnecessary details or redundancies, it will negatively affect the brand’s reputation. For example, if a company has duplicate data that hasn’t been removed due to inconsistent data maintenance, the sales team may accidentally target the same customer more than once. From there, customers will likely form a worse opinion of the company or opt out of future messaging. To prevent customer experience issues, businesses need a reliable data maintenance plan to ensure high-quality data.

Another factor contributing to poor customer experience is the Great Resignation. As employees exit in droves, companies lose the champions of their solutions. Without insights from dedicated employees, CRM data is in danger of being neglected and companies risk missing these critical issues until it comes time for renewal.

To further strengthen the customer experiences, companies should also consider automating their data management processes. Attempting to scale a manual process to meet the needs of a growing organization rarely succeeds. Additionally, the efforts to do so put unnecessary strain on operation and admin professionals within the organization. These professionals are critical in moving business initiatives forward, and bogging down their workload with redundant and repetitive data management tasks creates inefficiencies in the workflow. With leadership support, cross-functional teams can leverage tools and automation to make maintaining CRM data quality more user-friendly and help to retain top operations and admin talent.

Act on accounts faster with Salesforce integration

Now Pro and Enterprise users can sync accounts directly from Crunchbase to Salesforce, speeding up their prospecting workflow, and reducing time spent on manual data entry.

4. Boost sales employees’ retention and satisfaction

As the initial shockwaves of COVID-19 subside, many organizations are reevaluating their budgets at a time when companies are starting to realize that investing in data quality, and therefore their sales initiatives, should be a top priority. The sheer volume and velocity of data flowing into most CRM systems warrant making its management a full-time responsibility. To fully realize the benefits of high-quality CRM data, companies need to appoint a full-time guardian of the CRM and its data. Furthermore, teams will see best results from appointing a cross-functional data management team.

However, the reality is companies across the globe have been in survival mode for the past two years. Most haven’t had the budget to allocate to issues like data quality and the teams that maintain them, and that impacts the current talent. In the State of CRM Data Health Study, 64% said they would consider leaving their current role if additional resources are not allocated to a robust CRM data quality plan.

While CRM may have historically been recognized as a tool meant primarily for sales teams, its reach, impact and utility extend far beyond that because now the entire organization is dependent upon this system. Members of a successful data management team might be a combination of sales, marketing, operations, customer success, customer support, product managers and IT professionals. Only with a fully staffed team can data management truly be successful.

The importance of healthy data

No matter if a business is big or small, healthy data is critical when it comes to supporting the sales team and, ultimately, it should be the company’s bottom line. By investing in a qualified data management team, automating the data management process, and leveraging a technology partner, companies are setting themselves up for success and achieving a holistic view of their financial pipeline and the status of current leads.

The Lead List: 15 Hot Companies To Sell To In July

Global funding slowed dramatically in the second quarter of 2022. According to Crunchbase News, funding reached $120 billion, the lowest amount recorded for a single quarter since the beginning of 2021, Crunchbase data shows. Despite the significant drop in VC funding, 15 emerging unicorn companies raised new funding in June, collectively raising over $1.5 billion.

Why emerging unicorns should be on your radar: Emerging unicorns are private, high-growth companies valued between $500 million and less than $1 billion. Why should these companies matter to you? These not-yet unicorns (unicorns are private companies valued at $1 billion or above) represent a sweet spot for salespeople. They’re established, cash-rich, growing and solving a business problem that could make them the next billion-dollar unicorn.

These emerging unicorns span a variety of industries, including fintech, video streaming, edtech and artificial intelligence. In July’s edition of The Lead List, we’ll take a look at these high-growth startups and equip you with all the information you need to sell to them.

Hot tip for salespeople: In contrast to unicorns, which get all the attention, emerging unicorns may not be as inundated with sales pitches.

Add these rapidly growing companies to your CRM

Now Pro and Enterprise users can sync accounts directly from Crunchbase to Salesforce, speeding up their prospecting workflow, and reducing time spent on manual data entry. Check out this Crunchbase list and add these emerging unicorn companies to your CRM.

Methodology

This issue of The Lead List includes companies on Crunchbase’s Emerging Unicorn Board that raised new funding throughout June. The companies are ordered based on their Crunchbase rank score (a proprietary, dynamic ranking that uses intelligent algorithms to score and rank companies) as of July 1. An entity’s Crunchbase rank is fluid and subject to rise and fall over time due to time-sensitive events such as product launches, funding events and leadership changes, so the current rank score may not reflect the listed rank scores below.

The Emerging Unicorn Board is updated whenever a new company reaches a specific valuation range (between $500 million and less than $1 billion). Once a company reaches a valuation of $1 billion, it is classified as a “unicorn” and added to The Crunchbase Unicorn Board. Companies that exit through a public listing or acquisition are removed from the Emerging Unicorn Board.

If you have any questions about companies on the board or this list, please contact us at support@crunchbase.com.

1. Entrepreneur First

Crunchbase Rank: 6

Post-Money Valuation: $560 million

Entrepreneur First brings together ambitious founders with the potential to found globally important technology companies, to meet their co-founders and build a fast-growing startup from scratch. The company recently closed on a $158 million Series C with backing from some of the world’s most well-known founders. The backers represent major tech companies including Stripe, Wise, GitHub and LinkedIn, among others. In an interview with Silicon Republic, Entrepreneur First CEO, Matt Clifford said, “It feels right that this round of funding comes from the most successful technology founders of today. Their support will build their counterparts of tomorrow.”

Why Entrepreneur First should be on your radar: Entrepreneur First was founded on the belief that the world is missing out on some of its best founders. In particular, it believes the best companies come from co-founding partnerships. But finding the right person in your existing network can be hugely challenging. According to TechCrunch, “some of the funding will be used to continue investing in more entrepreneurs and their startups, and it will be converting that investment effort into an evergreen fund.” With its impressive list of backers from fast-growing companies, it would be smart to keep Entrepreneur First on your radar.

2. Juni

Crunchbase Rank: 26

Post-Money Valuation: $800 million

Juni is a fintech company that develops a banking app and platform for e-commerce and online marketing entrepreneurs. The company recently closed on a $100 million Series B led by Mubadala Capital Ventures, an active investor in advanced technology, with participation from EQT Ventures, Felix Capital, Cherry Ventures and DST Global. In addition to the Series B funding, the company also secured $106 million in debt financing from Silicon Valley-based TriplePoint Capital. With the new funding, Juni’s will focus on, “growing the business via its new credit card offering for all markets within the European Economic Area and the UK.”

Why Juni should be on your radar: In an interview with Sifted, Juni co-founder Samir El-Sabini shared that Juni hasn’t been impacted by the slowdown in consumer spending. “When the market is under pressure, you see that a lot of customers need to save costs and be more efficient. We’ve noticed that demand for our products is growing because you want to have the best liquidity possible,” El-Sabini said. “I’m not so worried about the number of customers — I’m worried about us being able to be at our best and make sure that we get the customers, that they trust us and that we can build something long-lasting together.” As the e-commerce sector continues to grow, and with the global e-commerce market predicted to reach $7 trillion in sales by 2025 — it might be worth setting up alerts for Juni and similar companies.

Crunchbase User Tip: Do you want to monitor Juni’s activity?

With Crunchbase Starter and Pro, you can enable automatic alerts to stay up to date on high-growth company news and buy signals. With automatic alerts, you can select what you want to be notified of (funding rounds, news, etc.) by designating either Daily or Weekly updates for that alert type. Learn more about automatic alerts.

3. Codat

Crunchbase Rank: 38

Post-Money Valuation: $825 million

Codat is the universal API for small business data. The company provides real-time connectivity to enable software providers and financial institutions to build integrated products for their small business customers. Codat closed on a $100 million Series C in early June, led by JP Morgan Partners. Canapi Ventures, Shopify, Index Ventures, PayPal Ventures and Plaid, which has been publicly named as an investor for the first time, also participated in the round. According to VCA Online, “Codat will use the funds to build out their critical infrastructure to be the default means of sharing data for the small business economy.”

Why Codat should be on your radar: In Codat’s Series C press release, Pete Lord, CEO and co-founder stated, “We’ll use our Series C funds to incorporate many more integrations into our universal API, connecting to all types and providers of small business financial software across the globe. Fintech pioneers will use our API to create products that solve a wide array of challenges that small business owners face, from accessing finance to process automation and many more that we are yet to imagine.” With high-growth companies like Plaid, Shopify and American Express backing them, Codat should be on your radar as the company continues to power the next generation of technology for small businesses and expands.

4. Stashfin

Crunchbase Rank: 50

Post-Money Valuation: $750 million

Stashfin is a neo-banking platform with a mission to deliver seamless, transparent and efficient financial services to everyone. The company aims to empower customers by improving their financial health leading to inclusivity, growth and economic independence. Stashfin closed on a $70 million Series C led by Uncorrelated Ventures, Fasanara Capital and Abstract Ventures with participation from Snow Leopard Technology Ventures, Kravis Investment Partners and Altara Ventures. The round was a mix of debt financing and equity, which brought the platform closer to unicorn status, valuing it at $750 million despite an overall slowdown in funding in Q2.

Why Stashfin should be on your radar: When asked about the funding round, Stashfin founder and CEO Tushar Aggarwal said, “The fundraising is a key milestone in this challenging macro environment. Stashfin began with the purpose to serve the underserved and unserved segments of our society, and it’s heartening to see this manifesting in rapid business growth impacting millions of our customers’ lives.” The company also looks forward to pursuing global expansion. Stashfin currently is based out of Singapore, yet only caters to the Indian market. According to Mint, “Stashfin will use the funds to expand its footprint in Southeast and South Asia and upgrade its technology for new products,” indicating a clear focus on company and product growth.

5. ShopBack

Crunchbase Rank: 92

Post-Money Valuation: $555 million

ShopBack is an e-commerce loyalty platform that offers cashback services from online stores. The company recently raised an $80 million Series F led by Asia Partners Fund Management, a growth equity firm focusing on investments in technology and technology-enabled companies. Existing investor January Capital also participated in the round. According to ShopBack’s press statement, “The capital will be invested into developing new and innovative products for users and merchant partners, deepening its presence across the Asia Pacific, and building capabilities for public market readiness.”

Why ShopBack should be on your radar: Today, ShopBack is the dominant player in Southeast Asia’s e-commerce cashback market, with an established presence in Singapore, Malaysia, Indonesia, the Philippines, Thailand and Taiwan. The funding announcement comes on the heels of the launch of ShopBack Pay, where over 2 million users in Singapore and Australia can now check out conveniently with ShopBack Pay at more than 3,000 merchant outlets. In addition to global expansion, ShopBack currently has a handful of open roles for which it is hiring. The majority of these roles are for its engineering and marketing teams, indicating a focus on product growth and expansion.

Crunchbase User Tip: Identity high-growth companies with buying power, like ShopBack, by leveraging Crunchbase’s leadership hire signal.

Crunchbase’s leadership hire signal can help you find companies that have the capacity and resources to buy a product or service. Leadership hire data will help you easily identify when companies have added a new executive (VP and above) to their leadership team, indicating that a company is expanding and that a new decision-maker is on board. Leadership hire is available as a filter on search, as well as on a company’s Crunchbase profile. Learn more about the leadership hire signal.

6. Coralogix

Crunchbase Rank: 127

Post-Money Valuation: $950 million

Coralogix is a SaaS platform that uses machine-learning algorithms to facilitate delivery and maintenance processes for software providers. The company closed on a $142 million Series D co-led by Advent International and Brighton Park Capital, with participation from Revaia, Greenfield Partners, Red Dot Capital Partners, O.G. Tech, StageOne Ventures, Joule Ventures and Maor Investments. The Israeli startup has currently raised $238.2 million to date, and according to Crunchbase data is approaching unicorn status with a valuation of $950 million. According to TechCrunch, the funding will be used to “continue investing in its [Coralogix] R&D as well as in building out more of its sales and business development globally.”

Why Coralogix should be on your radar: In the company’s Series D announcement post, it wrote, “As we move forward, and with this new round of funding, we are more committed than ever to providing our users with the best solution there is. We will continue growing our go-to-market, product, and R&D teams and expand into 10 new markets. As we expand, we will be focused on maintaining our world-class support and adding to and improving our full-stack observability platform.” In other words, the company plans to use its funding to further product development and expand its global geographic presence. As the company continues to grow and approach unicorn status, Coralogix could be your next big deal.

7. H1

Crunchbase Rank: 135

Post-Money Valuation: $773 million

H1 provides a global health care platform to help life sciences companies, hospitals, academic medical centers and health systems connect with providers, find clinical research, locate industry experts and benchmark their organizations. In July, the company announced a $23 million Series C extension in addition to the $100 million it raised in November, bringing the total Series C raise to $123 million. The round saw participation from Goldman Sachs Asset Management, Menlo Ventures, Transformation Capital and Novartis Pharma. The company is planning to use the extension to further its mission of creating a healthier future through the use of connected and accessible health care data.

Why H1 should be on your radar: Dubbed the LinkedIn of the health care industry, the participation from existing investors shows support for and confidence in H1’s trajectory to become the industry’s standard and trusted source of health care information. “In a time of volatile markets when many are struggling to secure funding, this extension is a vote of confidence in our ability to advance our mission,” said Ariel Katz, CEO and co-founder of H1. “Our ability to raise capital at the same terms as our original Series C close is a testament to our significant market opportunity and ability to execute against it.” With a focus on company and product expansion with their latest round of funding, H1 could be on the path to unicorn status.

Crunchbase User Tip: Want to find fast-growing companies similar to H1? Let Crunchbase find hyper-targeted sales leads for you.

With similar companies, it’s easy to identify companies that resemble your recently closed deals and figure out which companies with high-growth potential to watch. Crunchbase profiles now have a new ‘similar companies’ tab that utilizes our unique machine-learning model to automatically surface similar accounts and possible competitors for the profile you’re viewing. Similar companies makes it easier to discover and qualify accounts without interrupting your workflow.

8. Fountain

Crunchbase Rank: 168

Post-Money Valuation: $950 million

Fountain is a talent platform that makes workforce management and hiring easier. The company recently raised a $100 million Series C extension in addition to the $85 million it raised in November, bringing the total Series C funding to $185 million. The extension was led by B Capital Group, with participation from SoftBank Vision Fund, Mirae Asset Venture Investment, DCM Ventures, Origin Ventures, Commerce Ventures, SemperVirens Venture Capital and Uncork Capital. “This extension of our Series C is a testament to the incredible growth Fountain has seen over the past year and will help us to continue to exceed the demands of the world’s leading brands for high volume hiring,” said Sean Behr, CEO of Fountain.

Why Fountain should be on your radar: According to Behr, the company intends to use its fresh funding to expand internationally, “Bearing witness to Fountain’s proven value and growth potential, investors continue to be eager to support the company through an extension intended to supercharge its growth and fuel international expansion.” To support this global expansion, Fountain is rapidly hiring for 33 open roles, primarily for its engineering, sales and marketing teams, indicating a focus on product growth.

9. Pixellot

Crunchbase Rank: 195

Post-Money Valuation: $500 million

Pixellot develops artificial intelligence-driven sports production and analytics software for the semiprofessional sports market. The company recently announced it successfully raised a $161 million Series D in mid-June. The funding round was led by Providence Strategic Growth, a leading growth equity firm partnering with software and technology-enabled services companies to help accelerate their growth. Shamrock Capital Advisors and Firstime Venture Capital also participated in the round, according to Broadcasting+Cable,

Why Pixellot should be on your radar: Pixellot intends to use the funds to support its global market expansion and to enhance its video, analytics and highlights value proposition to fans, athletes and coaches at all levels. In addition, as part of the funding round, Ronen Nir, managing director at PSG, and Govind Anand, principal at PSG, have both joined Pixellot’s board of directors. According to Pixellot’s press release, “With this planned expansion of services, we [Pixellot] believes it is well-positioned to expedite its expansion into new territories and verticals, such as Asia, Latin America and the global youth markets.” With well-known companies like the NBA and MLB using Pixellot’s software, it would be smart to keep Pixellot on your radar as it continues to grow in popularity and expand worldwide.

10. Progcap

Crunchbase Rank: 203

Post-Money Valuation: $600 million

Progcap is a financial service company that provides financial opportunities for micro- and small businesses. The company recently closed on a $40 million Series C, led by Tiger Global Management and Creation Investments Capital Management LLC with participation from Sequoia Capital India and new investor Google. The company plans to use the funds to support its expansion and accelerate product development. “We are looking to expand our footprint to more geographies that we will be identifying and apart from that we are working on developing our app that helps to digitize our clients’ day-to-day finances,” co-founder, Pallavi Shrivastava told Economic Times.

Why Progcap should be on your radar: According to TechCrunch, “Progcap serves more than 700,000 small retailers, who dot hundreds of Indian cities and towns. The startup extends a revolving credit line of $10,000 to $12,500 to retailers, providing them with much-needed capital to buy new inventories and grow their businesses.” This makes Progcap a promising player in its sector given that it also has attracted the attention of Facebook and Amazon in recent years. In addition, Progcap’s Series C funding round nearly tripled its valuation to $600 million since its previous valuation of $200 million in September. The company is currently hiring for 17 positions across its sales and technology team, signaling a focus on growth and expansion as the company continues to scale.

11. Leap

Crunchbase Rank: 319

Post-Money Valuation: $900 million

Leap is an edtech company that develops a guidance and financing platform for aspiring overseas students. The company raised a $75 million Series D in late-June, led by Owl Ventures with participation from Steadview Capital, Sequoia Capital India, Paramark Ventures and Jungle Ventures . The company’s valuation has doubled since its September funding round as the company approaches unicorn status. According to Crunchbase News, the edtech sector saw a spike in funding last year. VC-backed companies in the education space raised more than $20 billion in 2021, up from around $14.6 billion in 2020, per Crunchbase data.

Why Leap should be on your radar: Leap said the new investment will allow it to widen access to quality global education and continue to expand globally. “We continue to see tremendous opportunities in the study-abroad segment. The pace of Indians moving abroad to study only continues to accelerate almost every passing year. And so, we are eyeing international expansion to UAE and Africa, so more students coming from any country can avail Leap’s products and services,” said Vaibhav Singh, co-founder of Leap. Keep Leap on your radar as the company is already inching closer to unicorn status with a valuation of $900 million.

12. Ataccama

CB Rank: 384

Post-Money Valuation: $550 million

Spun off from Adastra in 2007, Ataccama provides global enterprises with the ability to massively scale data-driven innovation to accelerate business outcomes. The company recently closed on a $150 million venture round, led by Bain Capital Tech Opportunities, representing a minority investment in the company.

Why Ataccama should be on your radar: The fresh funding will be used to strengthen the company’s go-to-market engine, further invest in new product innovation and expand its global reach. “These efforts will allow Ataccama to build on our significant growth and cement our position at the forefront of the data management and governance sectors,” the company said in a recent press release. “Ataccama’s cloud-friendly, best-in-class platform makes it simple for technical and nontechnical roles to collaborate on data quality and governance. Demand for the platform has driven a significant increase in the company’s average deal size, fueling incredible momentum. We see a significant runway for further growth,” said Dewey Awad, a managing director at Bain Capital Tech Opportunities. In addition, the company is hiring for multiple engineering and marketing positions, signaling a focus on company and product growth.

13. Vidio

CB Rank: 549

Post-Money Valuation: $850 million

Vidio is an over-the-top video platform that allows users to upload, watch and share videos. The company raised a $45 million venture round with a handful of investors including Dian Swastatika Sentosa, Grab and Bali United Football Club, an Indonesian football club. According to e27, “Vidio CEO Sutanto Hartono said the company is to increase its commitment to users by continuously adding the best premium content with this new fund, as well as improving the features and quality of the platform.”

Why Vidio should be on your radar: According to Deal Street Asia, “The additional funding will fuel the company’s pursuit to provide the best streaming content, and to upgrade features and the platform itself to provide reliable content.” In addition, Hartono said, “Aside from an exclusive Premier League airing in August and the World Cup in November, we will also be more aggressive in releasing local original series and quality soap operas to entertain streaming audiences in Indonesia.” The company is currently hiring for a handful of positions across it’s marketing and engineering teams, signaling a focus on growth and expansion as the company continues to scale.

14. Kerecis

CB Rank: 1,693

Post-Money Valuation: $550 million

Kerecis, which is headquartered in the small town of Ísafjörður, Iceland, makes use of fish skin and fatty acids in the globally expanding cellular therapy and infection control markets. The company recently raised a $50 million venture round, led by KIRKBI A/S, a Danish investment firm best known for being the owner of the LEGO brand.

Why Kerecis should be on your radar: According to Northstack, “Recently, Kerecis has been considering listing the company on the stock market in Sweden or the United States. The board of Kerecis has decided to abandon those plans, at least for now, in the light of the current economic landscape. Therefore, the board will have to look for other ways to fund the company’s growth. For example by securing funding from strong investors like KIRKBI.” Even without the possible IPO, Kerecis is still a company to keep on your radar as the company “experienced impressive growth in recent years and the goal is to keep that trend going. The company’s plans expect the gross income for the current financial year to more than double compared to last year’s gross income.”

15. Cleo

CB Rank: 11,119

Post-Money Valuation: $500 million

U.K.-based financial app Cleo has raised an $80 million Series C to double down on the U.S. market and help Gen Z audiences improve their financial health and well-being. The Series C was led by Sofina, a Belgium-based investment company that supports entrepreneurs and families managing growing companies, and backed by existing investors, including EQT Ventures and Balderton Capital. According to Sky News, “Sources close to Cleo said the new capital injection had been agreed at a valuation of about $500m – roughly five times the level of the December 2020 fundraising.”

Why Cleo should be on your radar: In an announcement post, Cleo said, “We are so excited to announce our Series C funding round led by Sofina. We’re doubling down on our growth and getting ready to fight even harder for the world’s financial health. We’ll be hiring a lot in the coming months. Chances are there’s going to be something for you here. (Including a product you can be proud of and really, really, great people.)” With a focus on hiring with their latest round of funding, Cleo currently has a handful of open roles. The majority of these roles are for its engineering, marketing and data science teams, indicating a focus on company and product growth.

Join us next month as we continue to keep an eye out for hot companies. You can use this list to track the cohort of new companies being added to the Emerging Unicorn Board throughout the month.

The Difference Between Inside and Outside Sales, Explained

There comes a time when every business needs to decide on its primary sales strategy, which usually means considering inside sales vs. outside sales, or settling on a blend between the two.

It’s no shock that the sales industry landscape has changed considerably over the last couple of years. Buyer behaviors have evolved, and the COVID-19 pandemic pushed the majority of salespeople into selling remotely. The big question for businesses is whether the trends we’ve witnessed in the 2020s so far will stick around for the long haul.

Choosing between inside and outside sales strategies affects your sales teams as well as your bottom line, so it’s vital to have a thorough understanding of both. In this guide, we’ll explain the difference between inside and outside sales, the responsibilities of inside vs. outside sales reps, and discuss which approach may be better for your business.

What is inside sales?

In short, inside sales is remote sales. Inside sales strategies leverage technology to connect with leads and convert them into customers without the need for either party to travel or meet in person. Possible communication channels include:

Any organization can utilize inside sales, but it has become a particularly dominant strategy among tech and SaaS companies and businesses in the B2C sphere. The specific channels your business uses will depend on the products and services you sell and your pricing strategy, although it’s standard practice to utilize a combination.

To gain a thorough insight into what is inside sales vs. outside sales, it also helps to know what inside sales are not. If your mind jumped straight to old-school single-strategy methods like cold calling and email tactics, you can relax; it’s not that. Nor is inside sales the same thing as telemarketing. Unlike telemarketing which is scripted, inside sales require skilled salespeople.

According to career development experts, inside sales is one of the fastest-growing roles in the sales sector, and even on a pre-pandemic scale, inside sales rep positions were growing 15 times faster than outside sales rep roles. The benefit of hiring inside sales employees is that they can be either office or home-based, allowing flexibility for companies that offer remote and hybrid working models.

What is outside sales?

Outside sales, also known as field sales, is the practice of selling products and services via face-to-face, in-person interactions, and it’s not uncommon for outside sales reps to travel extensively. The primary benefit of utilizing outside sales reps is that prospects receive a personalized sales experience with more detailed product information and demonstrations. Bolstered by the personal relationship fostered by the sales rep, this increases the chance of a conversion.

There are several places where outside reps meet with prospects. Pre-arranged meetings can take place virtually anywhere, including office spaces, other work sites, cafés, and restaurants. Other common locations include:

- Conferences

- Trade shows

- Industry events

- Seminars

- Video (Zoom calls, etc.)

With advanced sales tools, collaboration software, and automated workflow technology at their disposal, it’s now possible for outside sales reps to spend more time at home or in the office than before. In fact, outside reps already spend 89% more time selling remotely. In the last couple of years especially, this has been a vital consideration for reps deciding between outside vs. inside sales roles. Without digital strategies, many outside rep positions would undoubtedly have become obsolete during the global pandemic. However, now that restrictions are lifting, it is more feasible for them to get back on the road.

What is the difference between inside and outside sales?

As we’ve established, the primary difference between inside and outside sales is how you choose to market and sell your products and services. However, there are a few other key differences to consider:

- Sales cycle – Inside sales typically have shorter sales cycles because reps deal with less expensive products and services with smaller profit margins, meaning it’s a numbers game rather than a matter of chasing “big wins.” With outside sales, the annual account value (AVC) is usually higher, requiring prospects to make a bigger buying decision, which necessitates a more personal approach and relationship building leading up to purchase. Inside sales cycles can be as short as a few days, whereas outside sales reps may spend weeks, months, or even years building up to a sale.

- Close rate – On average, outside sales have a higher close rate than inside sales. This has nothing to do with a salesperson’s ability. It’s just the end result of a more people-focused approach and the amount of energy and resources allocated to closing a deal. Inside sales is more about economies of scale, so letting a lead go to chase a new prospect usually incurs a minimal loss. With outside sales, reps may have already spent months and thousands of dollars working towards a deal. So it’s not cost-effective to simply let a lead go cold.

- Customer acquisition cost (CAC) – The travel and time expenses racked up on pursuing outside sales vs. inside sales means the end cost of customer acquisition is usually much higher.

- Business type – As we highlighted earlier, inside sales are favored by companies selling modern technology and SaaS products, whereas industries like traditional hardware, manufacturing, and healthcare typically rely more on outside sales methodologies.

Of course, there is also a difference between outside and inside sales from a customer perspective in terms of expectation of service. Plus, there are distinct differences in attributes, experience, and skill sets when employing reps for each type of role. Let’s look at the difference between inside and outside sales job roles and responsibilities in more depth.

Inside sales rep responsibilities

The qualities to look for vary between inside vs. outside sales roles because the way they interact with your prospects is very different. The general day-to-day duties of an inside sales rep include:

- Identifying new leads.

- Making outbound contact with potential customers by phone, email, text, social media, etc.

- Explaining your unique selling proposition (USP) and describing product features and benefits.

- Maintaining contact with leads and nurturing sales.

- Creating and maintaining your customer database.

- Closing sales and achieving quotas.

Understanding customer needs is vital in both inside and outside sales, but there are several additional must-have qualities for inside salespeople. Here is a list of the main considerations when looking for inside sales reps:

Product Knowledge – Because inside sales reps have less time to make a conversion and cannot provide physical demonstrations, they need more in-depth product knowledge to convey the value of your products and services effectively.

Use of technology – Due to the focus on technology utilization, inside sales reps need to be comfortable using a range of hardware and software to effectively chase down leads remotely. A strong and reliable Wi-Fi connection is also a must.

Research skills – To bond with prospects quickly and facilitate a trusting relationship, inside salespeople need to be confident in gathering information from various sources. The best inside sales reps are social media savvy and can research efficiently on professional sites like LinkedIn to determine customer pain points for which your products and services present a solution.

Flexibility – Although inside sales positions are home or office-based, work hours are not always 9-5. Especially when working for companies with a multinational focus, reps may need to be available to provide information, answer questions, and handle objections across multiple time zones.

Strong communication skills – Because much of their customer contact is via phone or video conferencing, strong verbal communication skills are essential in making a good first impression and nurturing prospects through your sales pipeline. The best inside sales reps are adept at:

- Using strong language to shape prospect perceptions.

- Referencing examples of relevant work in the prospect’s arena of interest.

- Speaking concisely in a to-the-point fashion that is neither too brisk nor too lengthy.

- Utilizing silence to emphasize key points.

- Asking assertive questions.

Non-verbal communication – The ability to pick up on non-verbal buying signals and implications is an essential quality in an inside sales rep, because it allows them to perceive subtle – and even unintentional – hints from a prospect that can help them change tack or steer the conversation in a different direction.

Outside sales rep responsibilities

While there is inevitably some degree of crossover, there is considerable variance in roles and responsibilities, schedules, and daily tasks when comparing outside vs. inside sales rep positions. The general day-to-day duties of an outside sales rep include:

- Traveling within various sales territories to meet prospects. Or, meeting prospects via call or video.

- Attending face-to-face meetings and giving product demonstrations. Or, meeting via video and facilitating product demonstrations remotely.

- Educating customers about the financial and professional benefits of your products and services.

- Building and maintaining strong relationships with new leads and repeat customers.

- Monitoring market conditions, competitors, and new products to maintain a thorough understanding of customer needs.

- Maintaining accurate records of all leads and customer accounts.

- Working with your marketing department to help build brand awareness.

Outside sales reps are often the ones given superstar credit for closing big deals. Plus, because the job often comes with perks like attending social events such as corporate dinners, the position tends to be somewhat glamorized. However, it’s by no means an easy role. Here are some of the main criteria to consider when looking to hire outside sales reps:

Autonomy – In an ideal world, you want all of your employees to be strong team players, and outside sales rep roles are no exception. However, because they spend so much time on the road without the support of their teammates, a high degree of autonomy and independence is required.

Interpersonal skills – Because their success is primarily based on human interaction, outside sales reps must be confident, clear communicators with the ability to blend humor and lightheartedness with harder line sales approaches while maintaining prospect interest and trust. The best outside sales reps are also expert listeners who can accurately read body language.

Flexibility – While both inside and outside salespeople may need to make calls at unsociable hours, outside reps are often expected to drop tools and drive to wherever prospects and customers want to meet at short notice. Plus, last-minute changes are par for the course to accommodate changing schedules of prospects and customers in fast-moving industries.

Problem solving – Outside sales reps often need to think on their feet. Unlike inside sales reps who often communicate via email, they don’t have the luxury of time to consider their responses when posed with a question or objection. They must always be ready to give an on-the-spot answer or come up with a solution that meets the customer’s needs.

Organization – In addition to ensuring they are always in the right place at the right time to meet prospects and customers, outside sales reps need to keep their calendars and client accounts in pristine condition so that information is always up to date. Failing to record a progress update could be catastrophic if, for example, a rep becomes sick and their counterpart doesn’t have all the correct data and an up-to-date progress report to pick up from where they left off.

Should you use inside or outside sales?

There has been a noticeable shift toward inside sales in recent years, and the sector continues to expand rapidly. If you were to ask why this is, the stock response would likely be COVID-19 related. And while it’s true that the lockdowns that restricted access to in-person meetings certainly played a part, that’s not the full story. The pandemic merely acted as a catalyst for an already prevalent shift toward inside sales vs. outside sales approaches.

Today’s marketplace is moving increasingly online, and customers expect instant access to product information, easy price comparisons and customer assistance on a 24/7 basis. However, that doesn’t mean that you shouldn’t consider outside sales at all. Ultimately, the right approach will depend on the products and services you sell, the industry you operate in, and your overall sales strategy.

Products and services

The type of products and services you sell is one of the most significant factors determining which approach to use. Inside sales are more effective for small, inexpensive products and services that solve an immediate problem. One-time use products and services also sit in this category, along with any other product or service that can be bought quickly and conveniently without a particular need to speak with a salesperson first.

Outside sales are better for larger and more expensive products and services that solve a more complex problem or offer a long-term solution. In this instance, the decision to buy may take longer, involve many stakeholders, and require a stronger bond of trust between buyer and seller to close the deal.

Your industry

The nature of your business will always play a role in determining your ratio of inside and outside sales. Inside sales is typically a better fit for companies in the digital sector, with a focus on reaching as many new prospects as possible to maximize sales velocity. Outside sales is better for businesses selling physical products or companies targeting a more elite market, with a focus on creating long-term relationships with customers.

Sales strategy

The selling method you prioritize should match your overall sales strategy. Inside sales is generally considered a better fit for sales that can be automated through digital funnels. In contrast, outside sales is a better approach for strategies that include or require demonstrations or in-person meetings.

Remember that however you split your ratio of outside vs. inside sales reps, the end goal of both is the same: to sell more of your products and services and increase revenue. So there’s no hard and fast rule or perfect one-size-fits-all approach.

Whatever decision you make regarding outside sales vs. inside sales, you will inevitably face challenges that force you to adapt. For example, geographic growth may warrant a switch to a bigger inside sales team since it reduces overheads and spending on facilitating a physical presence. So it’s never simply a case of picking the most suitable method for right now and doggedly sticking with it. You should be constantly monitoring your progress so you can change your practices when necessary to maximize your efficiency and boost your close rates.

Trends in the Global Startup Ecosystem in 2022: Ranking 1,000 Cities and 100 Countries

The top country rankings

When compared with 2021, this year saw some significant movements in the startup scene. In fact, we have called 2022 “the year of global startup ecosystem uncertainty.” Below are some key insights:

- The “Big 4” Startup countries remain the same as in 2021: the U.S., U.K., Israel and Canada. Year by year, these countries demonstrated a constant level of stability and innovation and established strong startup economies. The U.S. remains the world leader across multiple industries and startup metrics, and maintains a total score that is 4x that of the second ranked country (the U.K.). The U.K. has solidified its position and substantially increased its gap from the third ranked country, Israel.

- Israel was a whisker away from overthrowing the U.K. in 2021, and is now not only far from it, but also has seen the national ecosystem of Canada, ranked fourth, narrowing gaps from it.

- Canada, in a successful year, has also created a substantial gap among all ecosystems ranked below it, bringing it back to the “Big 4” club of countries that have managed to create a gap from other countries.

- One of the most surprising decreases in the country ranking is China, losing three spots to now be ranked 10th globally. This has been a year of friction between Chinese founders and the state, which, among other elements, created the first negative index momentum of the Chinese ecosystem in the past years. As a result, Singapore, which is becoming a stronger regional hub every year, ranks seventh after a jump of three spots and is now the top-ranked country in Asia.

Top city ecosystems

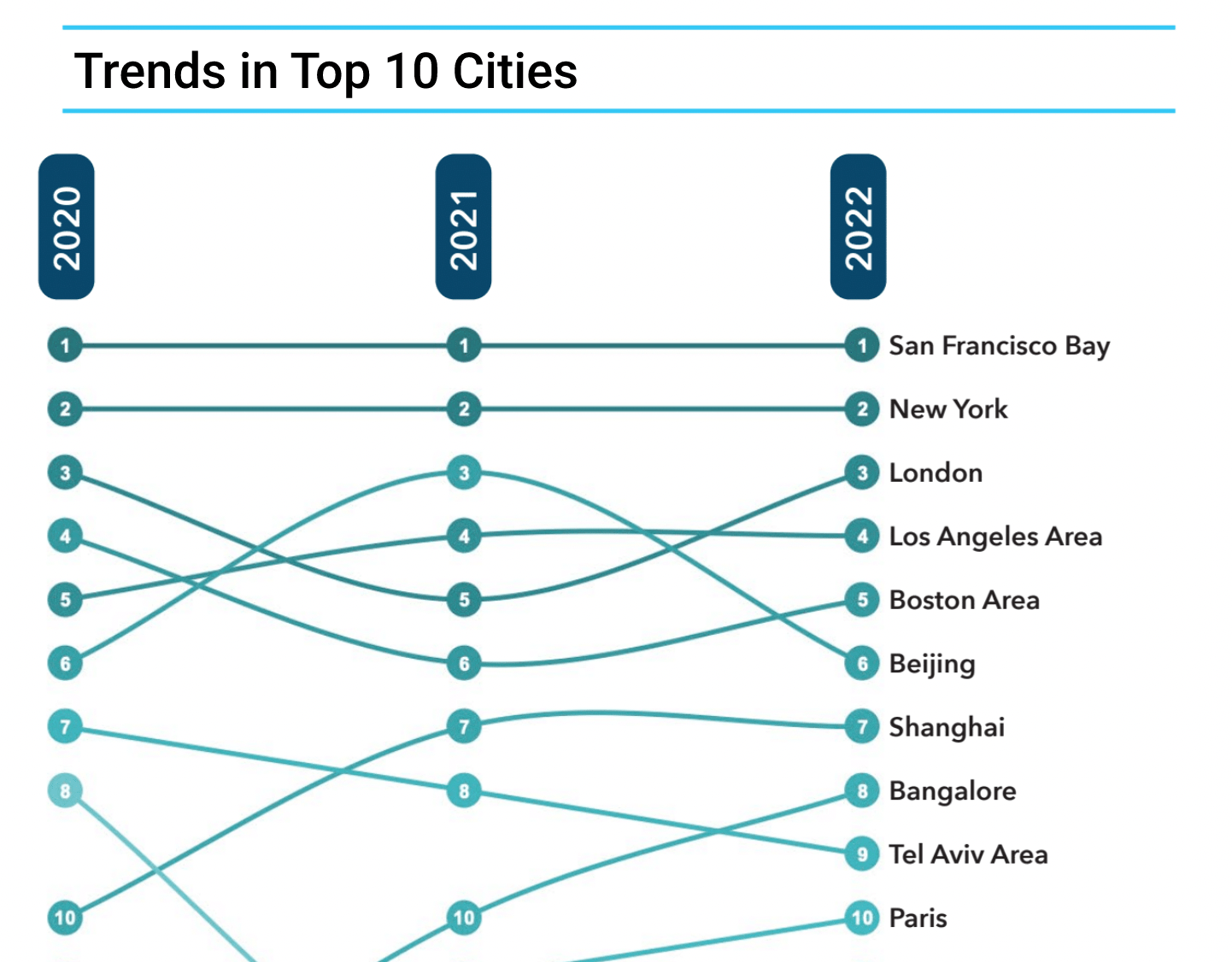

San Francisco remains the undisputed global leader in innovation, but New York, the world’s second-highest ranked, is continuing a trend of closing gaps with San Francisco. In 2019, the total score of San Francisco was roughly 5x higher than New York, and this year it narrowed to 2.5x. Ranked second in the U.S. and globally, New York formed its own solid and unique global and national tier.

As the U.K. strengthened its position, London advanced in the top three, globally displacing Beijing. Los Angeles is still ranked fourth, but Boston advanced to the fifth position, illustrating the dominance of the U.S.

Prompted by China’s loss in ranking, Beijing dropped to the sixth position, having a close total score with the Boston Area. On the other hand, ranked seventh, Shanghai maintained its 2021 position.

Bangalore had a particularly good year and consolidated its position in the top 10 after advancing two positions to rank eighth. Tel Aviv, Israel’s undisputed major hub, has dropped by one spot to rank ninth globally, with Paris (10th) slowly closing the gap and threatening Tel Aviv’s position next year.

Major trends in U.S. cities (represented in the index with 258 cities), include the increase of rankings of Chicago (ranked 13th), and the continued decrease of the ecosystem of Austin (ranked 20th), which still does not manage to close the gaps from the other top—yet less trendy—ecosystems in the U.S. The ecosystem of Salt Lake City-Provo (ranked 31st) is substantially increasing in the rankings, joining the U.S. top ecosystems.

Industry rankings

Based on a sample of more than 100,000 startup entities on the StartupBlink map, we can pinpoint interesting trends related to core startup industries. With no surprise, the biggest industry remains Software & Data, with 31.8% of our sampled startups.

Another interesting change this year is the surge of Healthtech startups. Consisting of 12.7% of our sampled data, the industry now registers 73 Unicorns, almost doubling its count in 2021. It seems COVID-19 has inspired many entrepreneurs to give renewed focus to this critical industry. The Social & Leisure industry represents 10.4% of total startups but has only managed to create 31 Unicorns.

Industries that demonstrate a better ability to scale are the Fintech and Ecommerce & Retail industries, each pertaining to roughly 10% of the startup sample, and generating 219 and 152 Unicorns respectively. Fintech has nearly doubled its Unicorn count since last year.

The rest of the industries lag behind in both representations in the sample and in the unicorn count. The most interesting of those industries is Transportation, which has just 2.6% of the sample but managed to produce 81 Unicorns.

It should be noted that San Francisco, although losing momentum, is ranked first in all 11 industries of the index. This is a testament to this ecosystem’s dominance across all sectors of the startup economy.

How A Founder-Turned-Investor is Funding and Supporting Female Founders

As an investor with Anthemis Group, Katie Palencsar leads the Female Innovators Lab in partnership with Barclays, which invests in early-stage female-founded fintech businesses. Previously, she founded and led the data SaaS company, Unbound Concepts.

In this Q&A, Palencsar discusses how she transitioned from founder to investor; what the fintech funding landscape looks like for women; and how her work with the Female Innovators Lab is doing things differently by funding and supporting female founders.

Q: How did you get into VC?

I’m an operator-turned-VC. I like to build new things: businesses, products, programs, teams, initiatives, funds or new revenue streams.

Previously, I founded and led a data SaaS company called Unbound Concepts from ideation to exit. The company’s data services, which also provided free software tools to 40,000-plus educators, were used by global distributors as well as privately owned and publicly traded publishers. The company was acquired by Certica Solutions in 2017. At that inflection point, I was working on a variety of projects, helping retired athletes with new tech and business opportunities, as well as having a moment to reflect on all I had experienced as a female founder. I realized two things really lit me on fire: early-stage companies (starting with a pitch deck and a dream); and driving capital and support to female founders.

When the opportunity came up at Anthemis Group to launch the Female Innovators Lab in partnership with Barclays, I was super intrigued because not only would it allow me to launch something new, but it would also allow me to work with early-stage companies where I could apply my operational experiences and expertise that would ultimately help and serve female founders.

Talk about some manifestation!

Q: Why did you choose to enter VC?

I didn’t really know what VC was until 10 years ago, so this wasn’t something I put in my high school yearbook highlights by any means. And in being on the other side of the table years ago as an operator, if you would have said I’d be doing this now, I would have said you were crazy. But the ecosystem has shifted so much in that time. Ten years ago it was unheard of for an investment firm to share portfolio diversity stats—and while there’s still massive amounts of work to do, this has completely shifted. And I feel both proud and excited to have been in the thick of the evolution of that experience for founders.

Having the opportunity to lead the Female Innovators Lab as its own fund with a dedicated group of people and resources alongside an established global fintech firm with a strong track record was super exciting.